how to calculate sales tax in oklahoma

The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name. This page discusses various sales tax exemptions in Oklahoma.

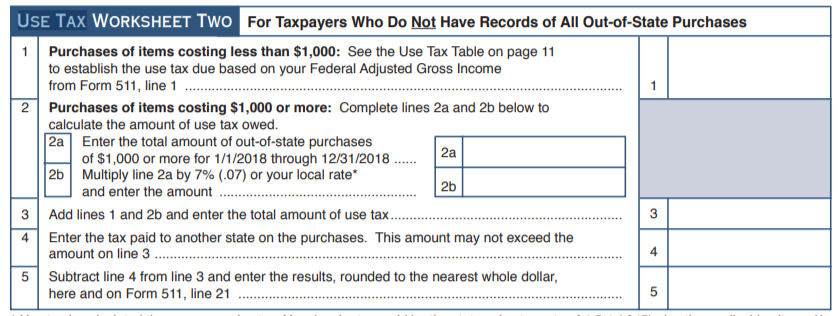

Do I Owe Oklahoma Use Tax Support

Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

. Employers calculate withholding tax by referring to an employees Form W-4 and the IRSs income tax withholding table to determine how much federal income taxes they should withhold from. Oklahoma provides a full exemption for Social Security retirement benefits. It can also be levied at the manufacturing level the wholesale level or at more than one but less than all levels of production or distributionRetail sales taxes which are prevalent in most of the states in the US.

She said it left her feeling confident people on all sides want to see the tax end. If his proposal is passed the change would be reflected in the Oklahoma Sales Tax Code and give a sales tax exemption for items eligible for purchase in the federal Supplemental Nutrition Assistance Program SNAP. In Oklahoma certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Sales tax can take several different forms. The base state sales tax rate in Texas is 625. Alone that would be the 14th-lowest rate in the country.

This free online Sales Tax Calculator will calculate the sales taxes on the price of a product or service given a sales tax percentage price plus tax and if you want will also tell you the number of hours you will need to allocate to working in order to pay for those taxes. Depending on local municipalities the total tax rate can be as high as 115. Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states.

Sales Tax Exemptions in Oklahoma. The state sales tax rate in Oklahoma is 450. You can also calculate the total purchase price using the Sales Tax Calculator or generate a table of sales tax due for various prices using the Sales Tax Table.

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue Service to cover tax payments. And are levied by some of the provinces in. It also provides a 10000 deduction toward other types of retirement income such as money from a 401k or a pension.

Roberts said with state revenue up and a current surplus in funds the economic climate is right for a cut to the sales tax. Some examples of items which the state. To file sales tax in Oklahoma you must begin by reporting gross sales for the reporting period and calculate the total amount of sales tax due from this period.

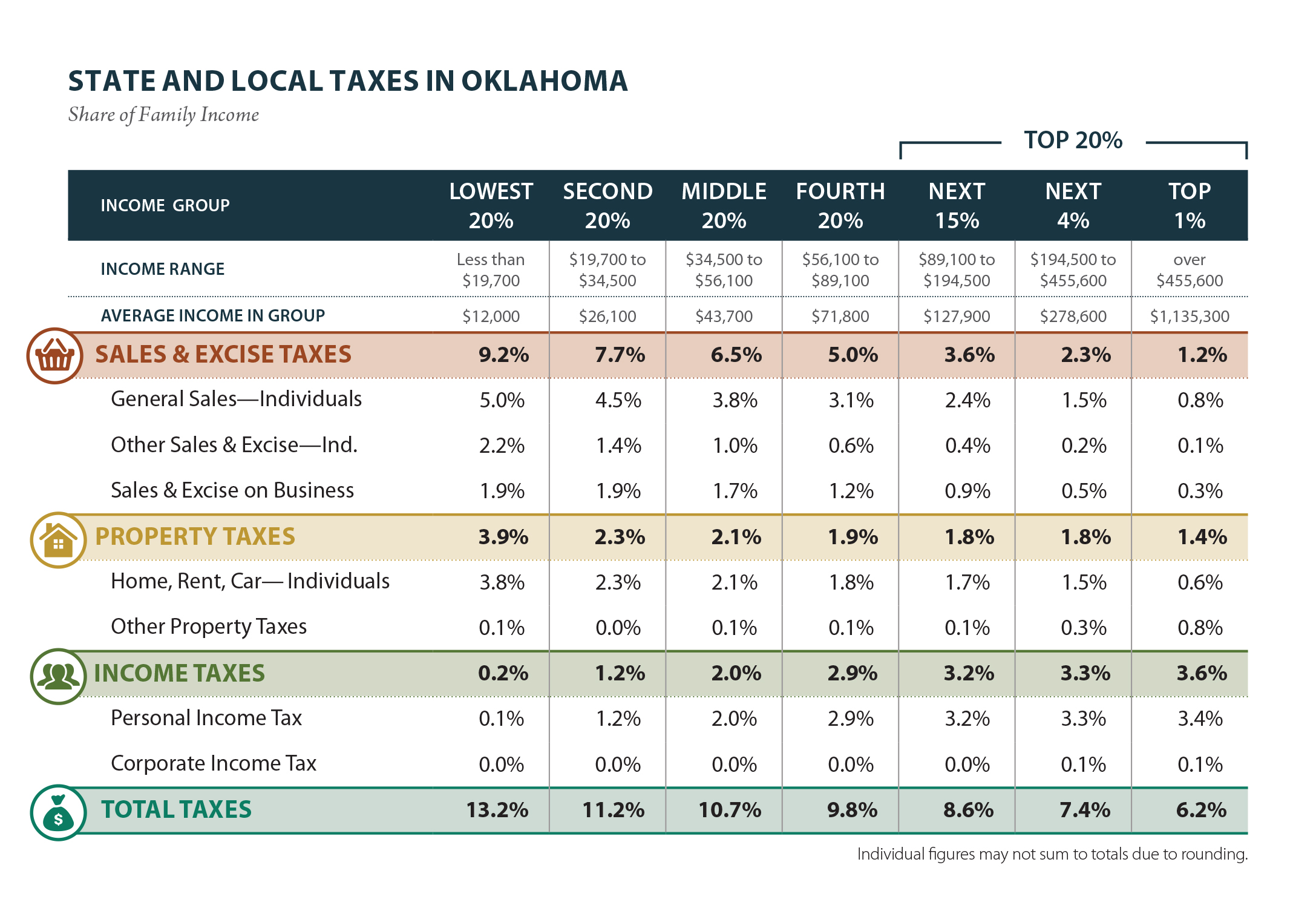

It can be imposed at a single or multiple stages of production or distribution. Although sales taxes in Oklahoma are high property taxes are fairly low. While the Oklahoma sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation.

A sales tax license also known as a sales tax permit or registration in some states is an agreement with the state tax agency to collect and remit sales tax on items sold by your business. Sales tax total amount of sale x sales tax rate in this case 8. To calculate the amount of sales tax to charge in New York City use this simple formula.

Find your Texas combined state and local tax rate. Oklahoma first adopted a general state sales tax in 1933 and since that time the rate has risen to 45 percent. Overview of Oklahoma Retirement Tax Friendliness.

The state of Oklahoma provides all taxpayers with three choices for filing their taxes. With a sales tax license youre required to collect state and local sales tax in the state that issues the license and then remit that money to the proper state or local taxing authority. The Oklahoma OK state sales tax rate is currently 45.

Ending the grocery tax keeps money in the pocket of low- and middle-income Oklahomans Virgin said in a news release shortly after the study. However in addition to that rate Oklahoma has the fifth-highest local sales taxes in the country tied with Louisiana the combined city. Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle.

Or to make things even easier input the NYC minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail you need. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Virgin commissioned a study last year on Oklahomas sales tax on groceries.

Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825.

Sales And Use Tax Rate Locator

Oklahoma Who Pays 6th Edition Itep

Oklahoma 2022 Sales Tax Guide And Calculator 2022 Taxjar

Improving Your Checkout Experience Through Case Studies Case Study How To Apply Improve Yourself

Total Sales Tax Per Dollar By City Oklahoma Watch

Oklahoma Sales Tax Small Business Guide Truic